Ameren: Wait For A Pullback In This Excessive-Yield Utilities Inventory (NYSE:AEE)

SimonSkafar

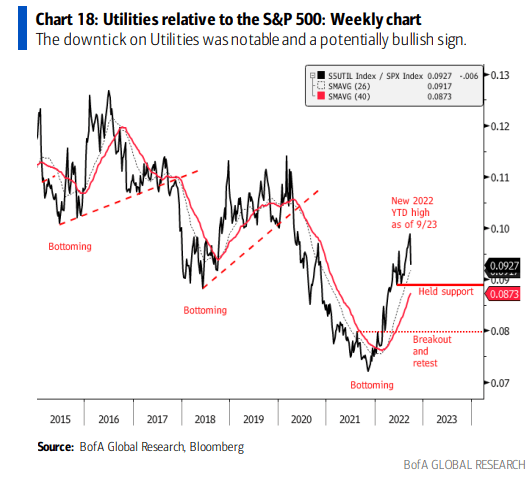

The Utilities sector had an enormous relative run versus the S&P 500 from late final 12 months by means of a lot of Q3. A giant September selloff within the supposedly defensive sector broke many particular person inventory charts, although. One large-cap participant with a giant presence within the Midwest is poised to learn from investments within the area, however shares don’t come cheaply.

Utilities Sector Relative to the S&P 500

BofA World Analysis

In response to Financial institution of America World Analysis and Constancy Investments, Ameren (NYSE:AEE) is a two-state regulated utility with operations in each Missouri and Illinois, together with each Gasoline and Electrical in addition to FERC regulated Transmission property. The agency operates as a public utility holding firm within the Midwest. It operates by means of 4 segments: Ameren Missouri, Ameren Illinois Electrical Distribution, Ameren Illinois Pure Gasoline, and Ameren Transmission. The corporate engages in rate-regulated electrical technology, transmission, and distribution actions; and rate-regulated pure gasoline distribution and transmission companies. It primarily generates electrical energy by means of coal, nuclear, and pure gasoline, in addition to renewable sources, akin to hydroelectric, wind, methane gasoline, and photo voltaic.

The Missouri-based $20.1 billion market cap Multi-Utilities trade firm inside the Utilities sector trades at a excessive 19.9 trailing 12-month GAAP price-to-earnings ratio and pays a stable 3.0% dividend yield, in keeping with The Wall Avenue Journal.

Ameren is well-positioned within the Midcontinent Impartial System Operator (MISO) footprint to learn from transmission buildout initiatives throughout the Midwest to assist enhance and transfer energy technology from wind and photo voltaic heavy provide areas to demand facilities like Chicago and additional east towards the PJM market. It will possibly additionally successfully elevate charges on this setting. Draw back dangers embody opposed regulatory adjustments and unfavorable rate of interest strikes.

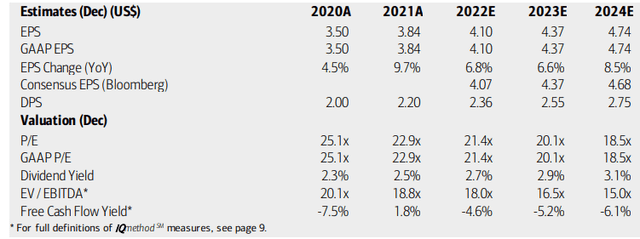

On valuation, BofA analysts see earnings rising at a gradual price by means of 2024. This sort of EPS stability is difficult to seek out throughout the sector and market. Bloomberg’s consensus per-share revenue development forecasts are about on par with BofA’s.

AEE’s working P/E continues to be excessive, nevertheless. So, that robust and constant earnings development comes at a worth. Additionally, different utilities pay greater yields than Ameren’s. Lastly, like most of the sector shares, this utility has destructive free money circulation given excessive capex. General, I just like the earnings and development photos, however the valuation is elevated.

Ameren Earnings, Valuation, And Dividend Forecasts

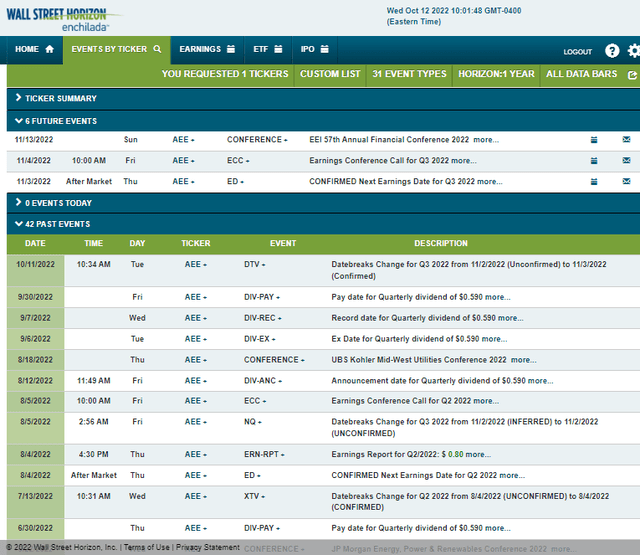

Wanting forward, company occasion information supplied by Wall Avenue Horizon exhibits a confirmed Q3 earnings date of Thursday, Nov. 3 AMC with a convention name instantly after outcomes are launched. You’ll be able to hear reside right here. Ameren’s administration group can also be anticipated to talk on the EEI 57th Annual Monetary Convention 2022 on Nov. 13 to fifteen. Each occasions might draw extra volatility in AEE’s inventory and choices.

Company Occasion Calendar

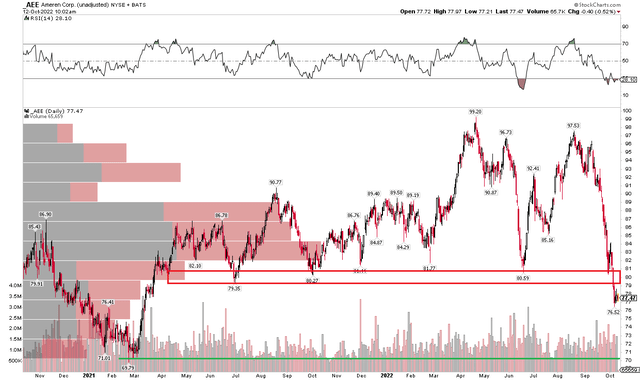

The Technical Take

With a excessive valuation however respectable development and enterprise positioning, how does the chart look? It is a bearish scene to me. Discover within the 2-year zoom under that AEE fell under a key assist vary between $79 and $82. I see additional draw back to the 2021 low close to $70. At that worth, the valuation can be a bit extra engaging, too.

Shares do have some assist from a excessive quantity of inventory traded from $70 to close $80, although. So it would take time to punch all the way in which right down to the $72 stage, however I feel that could possibly be within the playing cards. Lastly, AEE has a bearish ‘oversold’ RSI below 30. Whereas some prefer to say {that a} low RSI signifies a possible inventory bounce, it’s actually a sign that the bears are in management.

AEE Shares Fall Beneath Key Help As Bears Tighten Their Grip

The Backside Line

Ameren is positioned effectively to learn from broad funding traits within the Utilities sector. The inventory is just not a discount but although. I assert that ready for one more 10% draw back is warranted to convey the valuation again in verify. That is additionally the place AEE might fall to on the chart.