Estimating The Intrinsic Worth Of adidas AG (ETR:ADS)

At present we’ll run via a technique of estimating the intrinsic worth of adidas AG (ETR:ADS) by taking the anticipated future money flows and discounting them to at the moment’s worth. We’ll benefit from the Discounted Money Movement (DCF) mannequin for this goal. Earlier than you suppose you will not be capable of perceive it, simply learn on! It is truly a lot much less advanced than you’d think about.

Firms might be valued in a variety of methods, so we might level out {that a} DCF shouldn’t be good for each state of affairs. Anybody all in favour of studying a bit extra about intrinsic worth ought to have a learn of the Merely Wall St evaluation mannequin.

View our newest evaluation for adidas

The Calculation

We’re going to use a two-stage DCF mannequin, which, because the identify states, takes into consideration two levels of progress. The primary stage is usually a better progress interval which ranges off heading in direction of the terminal worth, captured within the second ‘regular progress’ interval. To start out off with, we have to estimate the following ten years of money flows. The place doable we use analyst estimates, however when these aren’t obtainable we extrapolate the earlier free money circulation (FCF) from the final estimate or reported worth. We assume corporations with shrinking free money circulation will gradual their charge of shrinkage, and that corporations with rising free money circulation will see their progress charge gradual, over this era. We do that to replicate that progress tends to gradual extra within the early years than it does in later years.

A DCF is all about the concept a greenback sooner or later is much less precious than a greenback at the moment, so we low cost the worth of those future money flows to their estimated worth in at the moment’s {dollars}:

10-year free money circulation (FCF) estimate

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF (€, Hundreds of thousands) | €1.69b | €1.54b | €1.90b | €1.65b | €1.50b | €1.41b | €1.35b | €1.30b | €1.28b | €1.26b |

| Development Fee Estimate Supply | Analyst x15 | Analyst x14 | Analyst x4 | Analyst x2 | Est @ -8.96% | Est @ -6.27% | Est @ -4.38% | Est @ -3.06% | Est @ -2.13% | Est @ -1.48% |

| Current Worth (€, Hundreds of thousands) Discounted @ 6.7% | €1.6k | €1.4k | €1.6k | €1.3k | €1.1k | €953 | €854 | €775 | €711 | €657 |

(“Est” = FCF progress charge estimated by Merely Wall St)

Current Worth of 10-year Money Movement (PVCF) = €11b

We now must calculate the Terminal Worth, which accounts for all the long run money flows after this ten 12 months interval. The Gordon Development system is used to calculate Terminal Worth at a future annual progress charge equal to the 5-year common of the 10-year authorities bond yield of 0.03%. We low cost the terminal money flows to at the moment’s worth at a price of fairness of 6.7%.

Terminal Worth (TV)= FCF2032 × (1 + g) ÷ (r – g) = €1.3b× (1 + 0.03%) ÷ (6.7%– 0.03%) = €19b

Current Worth of Terminal Worth (PVTV)= TV / (1 + r)10= €19b÷ ( 1 + 6.7%)10= €9.8b

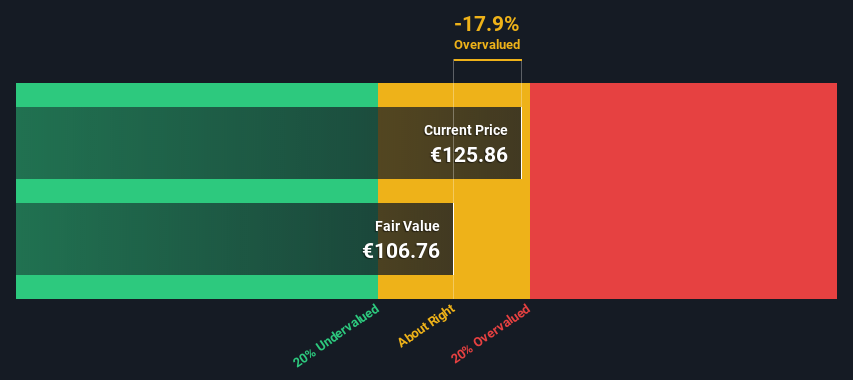

The overall worth is the sum of money flows for the following ten years plus the discounted terminal worth, which ends up in the Complete Fairness Worth, which on this case is €21b. To get the intrinsic worth per share, we divide this by the overall variety of shares excellent. Relative to the present share worth of €126, the corporate seems round truthful worth on the time of writing. Valuations are imprecise devices although, slightly like a telescope – transfer just a few levels and find yourself in a special galaxy. Do hold this in thoughts.

Vital Assumptions

Now an important inputs to a reduced money circulation are the low cost charge, and naturally, the precise money flows. A part of investing is developing with your individual analysis of an organization’s future efficiency, so attempt the calculation your self and examine your individual assumptions. The DCF additionally doesn’t take into account the doable cyclicality of an business, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. On condition that we’re taking a look at adidas as potential shareholders, the price of fairness is used because the low cost charge, slightly than the price of capital (or weighted common value of capital, WACC) which accounts for debt. On this calculation we have used 6.7%, which relies on a levered beta of 1.200. Beta is a measure of a inventory’s volatility, in comparison with the market as an entire. We get our beta from the business common beta of worldwide comparable corporations, with an imposed restrict between 0.8 and a couple of.0, which is an inexpensive vary for a secure enterprise.

SWOT Evaluation for adidas

- Debt shouldn’t be considered as a danger.

- Dividends are coated by earnings and money flows.

- Earnings declined over the previous 12 months.

- Dividend is low in comparison with the highest 25% of dividend payers within the Luxurious market.

- Costly primarily based on P/E ratio and estimated truthful worth.

- Annual earnings are forecast to develop sooner than the German market.

- Income is forecast to develop slower than 20% per 12 months.

Subsequent Steps:

Though the valuation of an organization is essential, it is just one of many elements that it’s essential to assess for a corporation. DCF fashions will not be the be-all and end-all of funding valuation. As a substitute the most effective use for a DCF mannequin is to check sure assumptions and theories to see if they might result in the corporate being undervalued or overvalued. For example, if the terminal worth progress charge is adjusted barely, it could dramatically alter the general consequence. For adidas, we have compiled three related gadgets it’s best to discover:

- Dangers: Bear in mind that adidas is displaying 3 warning indicators in our funding evaluation , it’s best to learn about…

- Future Earnings: How does ADS’s progress charge examine to its friends and the broader market? Dig deeper into the analyst consensus quantity for the upcoming years by interacting with our free analyst progress expectation chart.

- Different Excessive High quality Alternate options: Do you want an excellent all-rounder? Discover our interactive listing of top of the range shares to get an concept of what else is on the market you could be lacking!

PS. Merely Wall St updates its DCF calculation for each German inventory each day, so if you wish to discover the intrinsic worth of every other inventory simply search right here.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not adidas is doubtlessly over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to deliver you long-term centered evaluation pushed by basic information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.