Repsol (BME:REP) Appears To Use Debt Fairly Sensibly

Warren Buffett famously stated, ‘Volatility is much from synonymous with threat.’ Once we take into consideration how dangerous an organization is, we all the time like to have a look at its use of debt, since debt overload can result in wreck. As with many different firms Repsol, S.A. (BME:REP) makes use of debt. However ought to shareholders be fearful about its use of debt?

When Is Debt A Drawback?

Debt and different liabilities turn out to be dangerous for a enterprise when it can not simply fulfill these obligations, both with free money circulation or by elevating capital at a lovely value. Within the worst case situation, an organization can go bankrupt if it can not pay its collectors. Nevertheless, a extra frequent (however nonetheless expensive) prevalence is the place an organization should problem shares at bargain-basement costs, completely diluting shareholders, simply to shore up its steadiness sheet. In fact, the upside of debt is that it typically represents low cost capital, particularly when it replaces dilution in an organization with the power to reinvest at excessive charges of return. Once we look at debt ranges, we first contemplate each money and debt ranges, collectively.

View our newest evaluation for Repsol

How A lot Debt Does Repsol Carry?

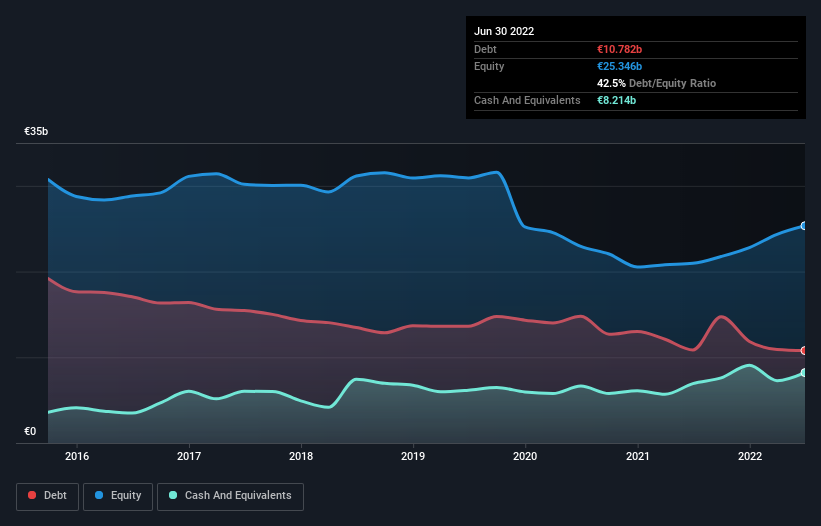

As you may see beneath, Repsol had €10.8b of debt, at June 2022, which is about the identical because the yr earlier than. You’ll be able to click on the chart for higher element. Nevertheless, as a result of it has a money reserve of €8.21b, its web debt is much less, at about €2.57b.

How Robust Is Repsol’s Stability Sheet?

Zooming in on the newest steadiness sheet knowledge, we are able to see that Repsol had liabilities of €21.8b due inside 12 months and liabilities of €16.2b due past that. Offsetting these obligations, it had money of €8.21b in addition to receivables valued at €10.9b due inside 12 months. So its liabilities outweigh the sum of its money and (near-term) receivables by €18.9b.

This can be a mountain of leverage even relative to its gargantuan market capitalization of €19.2b. This means shareholders can be closely diluted if the corporate wanted to shore up its steadiness sheet in a rush.

With a view to dimension up an organization’s debt relative to its earnings, we calculate its web debt divided by its earnings earlier than curiosity, tax, depreciation, and amortization (EBITDA) and its earnings earlier than curiosity and tax (EBIT) divided by its curiosity expense (its curiosity cowl). The benefit of this strategy is that we bear in mind each absolutely the quantum of debt (with web debt to EBITDA) and the precise curiosity bills related to that debt (with its curiosity cowl ratio).

Repsol has a low web debt to EBITDA ratio of solely 0.26. And its EBIT simply covers its curiosity expense, being 35.4 occasions the scale. So you could possibly argue it’s no extra threatened by its debt than an elephant is by a mouse. Higher but, Repsol grew its EBIT by 241% final yr, which is a powerful enchancment. If maintained that development will make the debt much more manageable within the years forward. The steadiness sheet is clearly the realm to concentrate on if you find yourself analysing debt. However it’s future earnings, greater than something, that can decide Repsol’s means to keep up a wholesome steadiness sheet going ahead. So in the event you’re targeted on the longer term you may try this free report displaying analyst revenue forecasts.

Lastly, whereas the tax-man could adore accounting earnings, lenders solely settle for chilly arduous money. So the logical step is to have a look at the proportion of that EBIT that’s matched by precise free money circulation. Over the latest two years, Repsol recorded free money circulation price 50% of its EBIT, which is round regular, given free money circulation excludes curiosity and tax. This chilly arduous money means it may well cut back its debt when it desires to.

Our View

Repsol’s curiosity cowl suggests it may well deal with its debt as simply as Cristiano Ronaldo may rating a objective towards an underneath 14’s goalkeeper. However the stark fact is that we’re involved by its stage of complete liabilities. Taking a look at all of the aforementioned components collectively, it strikes us that Repsol can deal with its debt pretty comfortably. In fact, whereas this leverage can improve returns on fairness, it does carry extra threat, so it is price maintaining a tally of this one. There isn’t any doubt that we study most about debt from the steadiness sheet. However in the end, each firm can comprise dangers that exist exterior of the steadiness sheet. We have recognized 4 warning indicators with Repsol (no less than 1 which is probably severe) , and understanding them needs to be a part of your funding course of.

When all is alleged and accomplished, generally its simpler to concentrate on firms that do not even want debt. Readers can entry a listing of development shares with zero web debt 100% free, proper now.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Repsol is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by basic knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.