Repsol (BME:REP) Is Rising Its Dividend To €0.2633

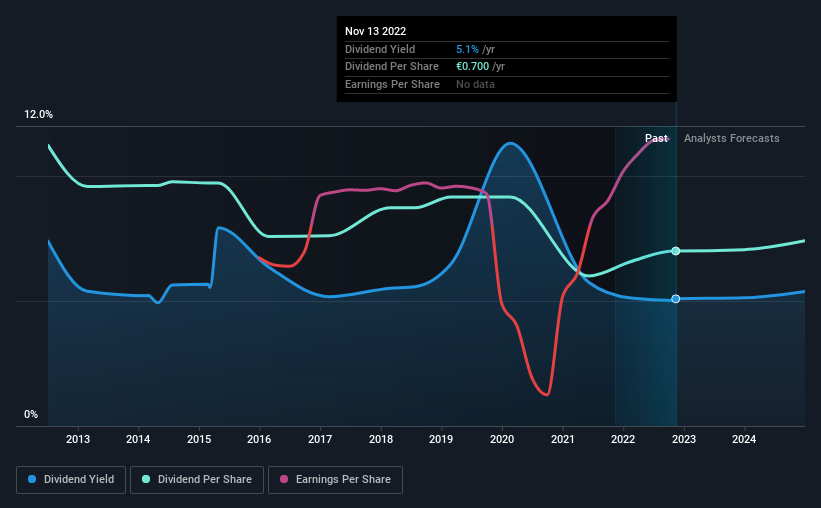

Repsol, S.A. (BME:REP) has introduced that it is going to be growing its dividend from final 12 months’s comparable fee on the eleventh of January to €0.2633. The fee will take the dividend yield to five.1%, which is in step with the typical for the trade.

Take a look at the alternatives and dangers throughout the XX Oil and Gasoline trade.

Repsol’s Dividend Is Nicely Lined By Earnings

We like a dividend to be constant over the long run, so checking whether or not it’s sustainable is essential. Earlier than making this announcement, Repsol was simply incomes sufficient to cowl the dividend. Because of this most of its earnings are being retained to develop the enterprise.

The subsequent 12 months is ready to see EPS develop by 8.5%. If the dividend continues alongside current developments, we estimate the payout ratio can be 19%, which is within the vary that makes us comfy with the sustainability of the dividend.

Dividend Volatility

Whereas the corporate has been paying a dividend for a very long time, it has lower the dividend at the very least as soon as within the final 10 years. Since 2012, the dividend has gone from €1.12 whole yearly to €0.70. The dividend has shrunk at round 4.6% a 12 months throughout that interval. An organization that decreases its dividend over time usually is not what we’re in search of.

The Dividend Seems Probably To Develop

Rising earnings per share might be a mitigating issue when contemplating the previous fluctuations within the dividend. Repsol has seen EPS rising for the final 5 years, at 19% every year. With a good quantity of development and a low payout ratio, we expect this bodes effectively for Repsol’s prospects of rising its dividend funds sooner or later.

We Actually Like Repsol’s Dividend

Total, a dividend improve is all the time good, and we expect that Repsol is a powerful revenue inventory because of its observe document and rising earnings. Earnings are simply protecting distributions, and the corporate is producing loads of money. Taking this all into consideration, this appears to be like prefer it might be an excellent dividend alternative.

Traders have a tendency to favour corporations with a constant, secure dividend coverage versus these working an irregular one. Nonetheless, traders want to think about a bunch of different elements, aside from dividend funds, when analysing an organization. For instance, we have recognized 3 warning indicators for Repsol (1 is a bit regarding!) that you ought to be conscious of earlier than investing. Searching for extra high-yielding dividend concepts? Strive our assortment of sturdy dividend payers.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Repsol is probably over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to convey you long-term centered evaluation pushed by elementary information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.